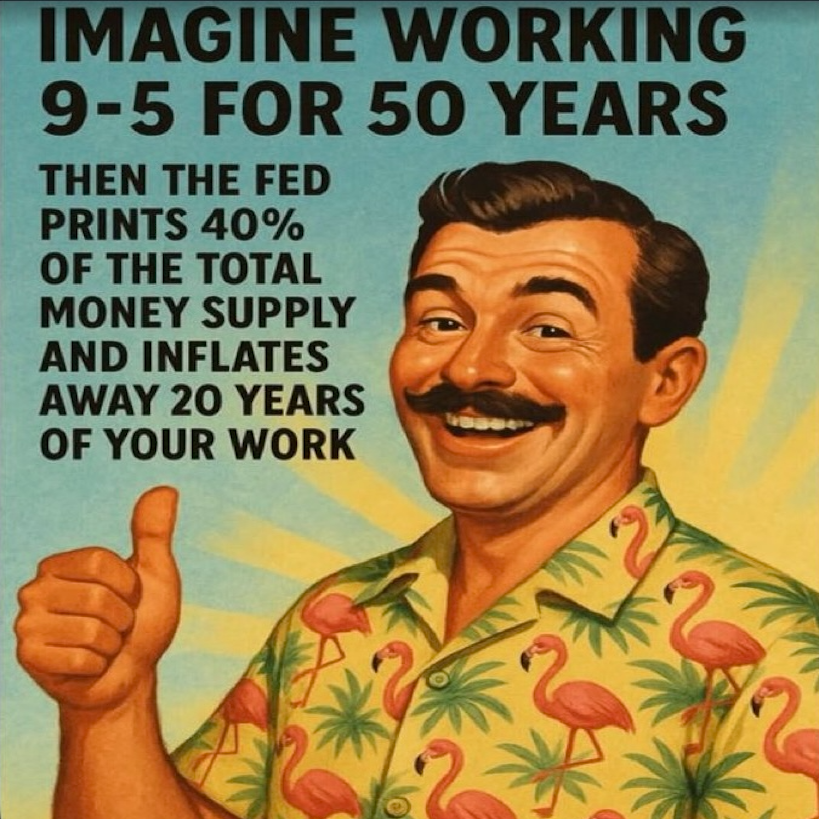

Don’t work to save your money. Why? Because your money is “fiat” and banks and governments can create more of it, inflating the money supply and deflating the value of your savings.

Prior to money becoming Fiat money (prior to 1971) your grandparents could work and could plan for their future, because their money was still worth something at the end of the day. Governments couldn’t print like crazy because money was tied to gold. That is no longer the case.

Fiat is created out of nothing. It’s not backed by anything of value. Its only value comes from the fact that we trust it has value, but its worth is constantly being diminished, because more and more of it is being created, every day.

When there’s more money floating around, but the same amount of stuff to buy, prices go up. That is inflation. It’s a hidden tax on your stuff, what you own, what you save. If you have $10000 saved, and prices rise by 5% per year, your money will only be able to buy $9500 worth of stuff. That means you have to work harder to keep up.

Who benefits from Fiat money. NOT YOU.

So what can you do? You can start asking some questions, like:

- Why does our money system work this way?

- How can I protect my savings?

- Is there an alternative?

Learn about Bitcoin. The more you know, the more you can control your financial future.