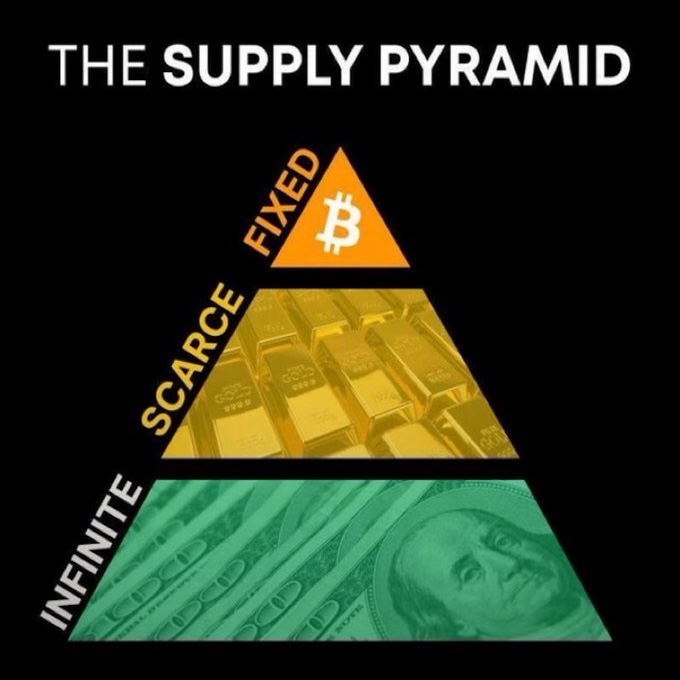

Bitcoin’s supply is fixed, it cannot be increased.

There are only 21 million Bitcoin, and that is it. Nothing more. If you have 1 bitcoin, and others want your bitcoin, it will get more and more expensive as the time goes by. This is because the less there is of something, and the more demand there is for it, its price increases.

Gold, on the other hand, is mined from the ground at approximately 2% per year. What does this mean? It means available supply increases constantly. That means that while it’s a relatively scarce asset, more gold is available every year. So, if others want your gold, sure, it may be a little bit more expensive, but there will be more gold available in the market every year. And if mining gold gets cheaper with tech improvements, its supply can grow more than 2% per year. Gold will then be worth less, instead of more.

Currency, or fiat, or “money” as it’s commonly known as, is “printed” limitlessly, year on year and at the whim of those in control of the money supply. This means there are more and more dollars created every year. What happens when you have more and more of something? Its value diminishes, and over time it tends to become worthless.

The take away? Get off the fiat trap, your currency is becoming worthless. The $1000 dollars you have today will be worth less next year, and much less the year after that, and so on.

Start holding bitcoin, the only truly scarce and finite asset.